Several factors affect your credit scores, especially on-time payments and how much of your credit limits you use.

Your credit scores are determined by several factors, such as whether you pay bills on time and the length of time you’ve used credit. Understanding what factors affect credit scores helps you plan the most effective way to build your credit or protect it.

Credit scoring companies calculate your scores from data in your credit reports. While they won’t reveal their exact formulas, they share the basic ingredients they use to calculate scores.

Why do you care? Because your credit often holds the key to other parts of your life: whether you can get a credit card or car loan, and at what interest rate; whether you can buy a house or rent the apartment you want; even how much you pay on car insurance and utility deposits.

The factors that affect credit scores most

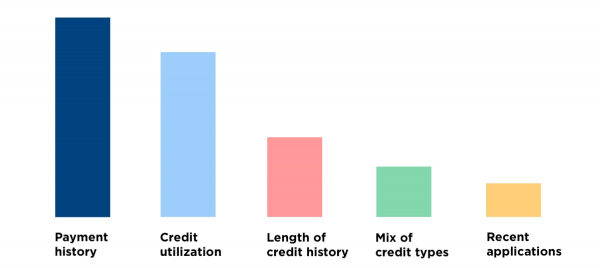

The two major scoring companies in the U.S., FICO and VantageScore, differ a bit in their approaches, but they agree on the two factors that are most important. Payment history and credit utilization, the portion of your credit limits that you actually use, make up more than half of your credit scores. Focus your attention mostly on those two while keeping an eye on the other factors.

Here’s a breakdown of all the factors that affect your scores:

Payment history

Your credit reports reveal your payment history, or whether you’ve consistently paid bills and other obligations on time. FICO says payment history accounts for 35% of your score. VantageScore doesn’t give percentages, but it calls payment history “extremely influential.”

What to do: Pay all bills on time. Paying bills late by 30 days or more can dent your scores — and the later you pay, the greater the damage. Set up autopay or calendar reminders so you don’t miss due dates. You might also want to ask creditors to move your due dates so they better align with when you get paid.

Credit utilization

The amount of your credit limit you use, expressed as a percentage, is called credit utilization. FICO says the amount of available credit you use counts for 30% of your score, while VantageScore calls credit utilization “highly influential.”

What to do: Experts recommend using no more than 30% of your available credit. People with the highest scores tend to use much less than that. To keep your credit utilization low, you can try things like setting balance alerts or making extra payments during the month.

The good news is that score damage from having high credit utilization can be reversed. Once you pay a high balance down and the creditor reports it to the credit bureaus, the damage disappears.

Other credit score factors you should know about

Once you’ve mastered paying on time and keeping credit utilization low, turn your attention to other credit factors. These also affect your scores, though not nearly as much:

The length of time you’ve had credit: Longer is better, so keep old accounts open unless there is a compelling reason to close them, such as an annual fee on a card you no longer use. You might be able to help yourself a little in this category by becoming an authorized user on an old account with an excellent payment record.

The kinds of credit you have, or credit mix: It’s best to have a mix of installment accounts — those with a set number of equal payments, such as car payments or mortgages — and credit card accounts.

The length of time since you’ve applied for new credit: Each application that causes a hard inquiry on your credit may take a few points off your score.

Total balances and debt: It’s best if you’re making progress in paying off your debt.

Factors that don’t affect your credit score

Checking your own score: If you get your own score through your bank or a free credit score service, it does not affect your score. That’s because checking your own score is considered a soft pull on your credit. You can check it as many times as you want with no impact to your score.

Rent and utility payments: In most cases, your rent payments and your utility payments are not reported to the credit bureaus, so they do not count toward your score. The exception is if you use a rent-reporting service or if you are late on utility payments. The utility company may charge it off or sell it to a collector, who can report it to the credit bureaus and hurt your score. Some new products, such as Experian Boost, allow you to add utility payment information to your Experian credit report, which can influence your credit.

Income and bank balances: Credit reports do include some employer information, but it’s used only to match account data to the right person. Getting a raise won’t bump up your score. And since reports list only credit accounts — not savings, checking or investment accounts — your balances in those also won’t help your score.

How to use your newfound knowledge

Credit scoring companies review your credit reports to see how you’re doing on all these factors. Then they build your scores from that data. You can see the same things they do by checking your credit reports.

Focus your credit-building efforts on on-time payments and keeping balances low relative to credit limits, because those factors have the biggest effect on your scores. You can track your score and get personalized tips with MAD Credit Academy free credit score Analyst.